With Japan on the brink of multiple nuclear meltdowns, who the hell is still buying JGBs? When you think of a bankrupt country like Japan with total debt-to GDP of 210%, a yearly budget deficit of over 10% (and rising because of the disasters), and a government issuing more JGBs per year than in collects in tax revenue, you come to the conclusion that buying JGBs as a safe haven asset is nothing short of suicidal. But that is exactly what happened in our bizarro financial markets on Friday when Japanese debt across the curve rose as investors flocked to government bonds despite horrendous fundamentals. If this does not prove that the Japanese bond market is out of its mind, I don't know what will. Let's consider a few easily deducible facts concerning the disaster in Japan. Economic growth will slow dramatically (on the margin a positive for JGBs), but the government will likely face a serious deterioration in its finances. Lower growth, means less tax revenue, which inevitably leads to more JGB issuance (negative for bonds). Furthermore, you can guarantee that the Keynesian aficionados in Japan will be coming up with some kind of stimulus package to help rebuild hard hit areas. This means even more debt issuance coming to the market. No doubt the zombie markets are betting the BOJ will come to the rescue and simply print more counterfeit yen to "ease financial conditions." To be sure it has worked in the US as the Fed has successfully done to keep the world's largest ponzi economy floating on POMO asset pumping.

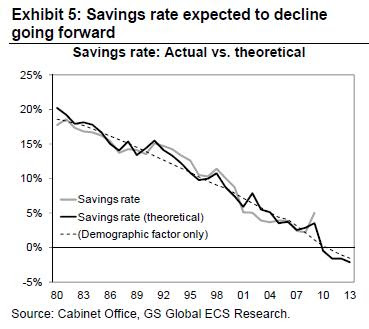

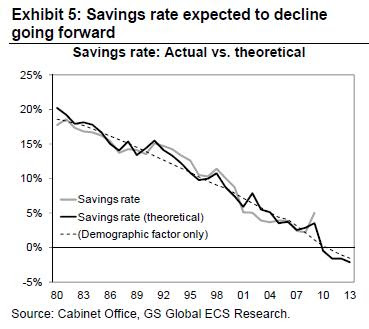

The question, then, is: When will the market start to turn on Japan and recognize that a default is not simply a possibility, but a 100% eventuality? The only debate is when: 1, 3,5,or 10 years? I wonder if this latest disaster in Japan could be the camel that broke the back of the JGB market. After all, foreigners have largely abandoned the JGB market as rates are unattractive compared to better countries like Australia, Indonesia, etc. Without foreign support, it is up to Japanese consumption of endless government bonds to keep the ponzi scheme running. Japan's saving rate has been declining along with the aging of the population. Look at the chart below. What makes matters worse is that Goldman Sachs is predicting that the savings rate will actually turn negative in the coming years.

If these factors were not enough to dissuade people from buying JGBs, how about the fact that Japan is literally facing a nuclear meltdown in 3-5 of its nuclear reactors. If the worst case scenario happens, large amounts of radiation could be disbursed throughout the country, rendering many areas inaccessible. Apparently, the government central planners in Tokyo never thought about the dangers of building nuclear power plants on an island that is prone to large earthquakes! What could possibly go wrong? But don't worry, the Japanese government has a plan: They are telling people to stay in their homes and cover their faces. Thanks a lot; that will keep the people of Japan confident in their government.

If the government continues to mislead people and generally F-k up the whole disaster relief situation, why on earth would the people of Japan continue to buy JGBs? If anything, they may have to sell their government bond holdings to pay for necessities like food, water, shelter, and clothing. I am thinking that the original safe haven buying of JGBs was more of a knee-jerk reaction which should not be short-lived. In fact, JGBs should be selling off as corporations and individuals raise capital for reconstruction activities. This would have the affect of raising Japan's interest costs, further burdening an already battered country.

Regarding the Nikkei, this is probably the easiest trade in the world--Sell short! If you look at what happened back in 1995 with the Kobe earthquake, the Nikkei fell 8% in the first few days and went down 25% over the next 6 months (while the yen surged). Below is a chart from Bespoke which shows the Nikkei in 1994-1996. If a similar event occurs now, it would make Japanese export stocks a pretty good value. Marc Faber has recently said that the Japanese stocks were cheap based on valuation and that the 20 year bear market in stocks was coming to an end. With the earthquake depressing stocks further, investors may be able to make some money bottom fishing Japanese equities after the initial decline. You would want to focus on companies with little exposure to the domestic Japanese economy (except reconstruction activities) and levered to global and Asian growth.

Chart Nikkei 225

You can see from the chart above that there was no reason to try to pick a bottom early in the Japanese market. It took about a year for equities to finally bottom out, giving investors a good opportunity to select high quality stocks.

One last thing I wanted to discuss is the impact the Japanese nuclear fallout will mean for

uranium and

nuclear energy (both of which I am bullish on). It is obviously a short-term negative as the environmentalists use this as a way to prevent the development of more

nuclear power plants around the world. Despite the fact that

nuclear energy is the only practical option for replacing oil, nat gas, and other fossil fuels. And no, little greenies (including Barry Obama in the WH), solar and wind will not save us. Sun has an arch-nemis called night, which renders it as useless as a little girl to a Catholic priest. Wind is hindered by the fact that it is not constant and requires natural gas to turn the damn windmills as a back up energy source. But how about ethanol? Brilliant suggestion-- let's burn much needed food to produce fuel when food prices are near all-time highs, and millions around the world are starving to death. Genius! If you believe in ethanol as a legitimate fuel source, you obviously need to be lobotomized and given powerful anti-psychotic medication. Furthermore, people like you should lose their right to vote based on a severe lack of reasoning skills.

While the greenies will impact the short-term development of nuclear plants in the Western countries, construction in developing countries (which are building the majority of new plants) like China, Russia, and India will be largely unaffected (see proposed nuclear plant construction below). According the World Nuclear Association,

nuclear power capacity is expected to double by 2030 as countries look for alternatives to traditional energy sources. Dictatorships like Communist China could really care less about

anti-nuclear protesters blocking the constriction process. If anybody puts up any resistance, they simply send in the military to beat back the crowds and take the leaders to undisclosed torture facilities for re-education. What this means is that longer term, the Japanese incident will not materially impact future construction of

nuclear plants, except for the obvious fact that you should not build

nuclear reactors near earthquake prone regions!

Nuclear Power reactors under construction, or almost so

Start Operation* REACTOR TYPE MWe (net)

2011 India, NPCIL Kaiga 4 PHWR 202

2011 Iran, AEOI Bushehr 1 PWR 950

2011 India, NPCIL Kudankulam 1 PWR 950

2011 Korea, KHNP Shin Kori 1 PWR 1000

2011 Argentina, CNEA Atucha 2 PHWR 692

2011 India, NPCIL Kudankulam 2 PWR 950

2011 Russia, Energoatom Kalinin 4 PWR 950

2011 Korea, KHNP Shin Kori 2 PWR 1000

2011 China, CGNPC Lingao II-2 PWR 1080

2011 Japan, Chugoku Shimane 3 ABWR 1375

2012 Taiwan Power Lungmen 1 ABWR 1300

2011 Canada, Bruce Pwr Bruce A1 PHWR 769

2012 Canada, Bruce Pwr Bruce A2 PHWR 769

2011 Pakistan, PAEC Chashma 2 PWR 300

2011 India, Bhavini Kalpakkam FBR 470

2012 Finland, TVO Olkilouto 3 PWR 1600

2012 China, CNNC Qinshan phase II-4 PWR 650

2012 Taiwan Power Lungmen 2 ABWR 1300

2012 Korea, KHNP Shin Wolsong 1 PWR 1000

2012 Canada, NB Power Point Lepreau 1 PHWR 635

2012 France, EdF Flamanville 3 PWR 1600

2012 Russia, Energoatom Vilyuchinsk PWR x 2 70

2012 Russia, Energoatom Novovoronezh II-1 PWR 1070

2012 Slovakia, SE Mochovce 3 PWR 440

2012 China, CGNPC Hongyanhe 1 PWR 1080

2012 China, CGNPC Ningde 1 PWR 1080

2013 Korea, KHNP Shin Wolsong 2 PWR 1000

2013 USA, TVA Watts Bar 2 PWR 1180

2013 Russia, Energoatom Leningrad II-1 PWR 1070

2013 Korea, KHNP Shin-Kori 3 PWR 1350

2013 China, CNNC Sanmen 1 PWR 1250

2013 China, CGNPC Ningde 2 PWR 1080

2013 China, CGNPC Yangjiang 1 PWR 1080

2013 China, CGNPC Taishan 1 PWR 1700

2013 China, CNNC Fangjiashan 1 PWR 1080

2013 China, CNNC Fuqing 1 PWR 1080

2013 China, CGNPC Hongyanhe 2 PWR 1080

2013 Slovakia, SE Mochovce 4 PWR 440

2014 China, CNNC Sanmen 2 PWR 1250

2014 China, CPI Haiyang 1 PWR 1250

2014 China, CGNPC Ningde 3 PWR 1080

2014 China, CGNPC Hongyanhe 3 PWR 1080

2014 China, CGNPC Hongyanhe 4 PWR 1080

2015 China, CGNPC Yangjiang 2 PWR 1080

2014 China, CNNC Fangjiashan 2 PWR 1080

2014 China, CNNC Fuqing 2 PWR 1080

2014 China, CNNC Changiang 1 PWR 650

2014 China, China Huaneng Shidaowan HTR 200

2014 Korea, KHNP Shin-Kori 4 PWR 1350

2014 Japan, Tepco Fukishima I-7 ABWR 1380

2014 Japan, EPDC/J Power Ohma ABWR 1350

2014 Russia, Energoatom Rostov 3 PWR 1070

2014 Russia, Energoatom Beloyarsk 4 FNR 750

2015 Japan, Tepco Fukishima I-8 ABWR 1380

2015 China, CGNPC Yangjiang 3 PWR 1080

2015 China, CPI Haiyang 2 PWR 1250

2015 China, CGNPC Taishan 2 PWR 1700

2015 China, CGNPC Ningde 4 PWR 1080

2015 China, CGNPC Hongyanhe 5 PWR 1080

2015 China, CGNPC Fangchenggang 1 PWR 1080

2015 China, CNNC Changiang 2 PWR 650

2015 China, CNNC Hongshiding 1 PWR 1080

2015 China, CNNC Taohuajiang 1 PWR 1250

2015 China, CNNC Fuqing 3 PWR 1080

2015 Korea, KHNP Shin-Ulchin 1 PWR 1350

2015 Japan, Tepco Higashidori 1 ABWR 1385

2015 Japan, Chugoku Kaminoseki 1 ABWR 1373

2015 India, NPCIL Kakrapar 3 PHWR 640

2015 Bulgaria, NEK Belene 1 PWR 1000

2016 Korea, KHNP Shin-Ulchin 2 PWR 1350

2016 Romania, SNN Cernavoda 3 PHWR 655

2016 Russia, Energoatom Novovoronezh II-2 PWR 1070

2016 Russia, Energoatom Leningrad II-2 PWR 1200

2016 Russia, Energoatom Rostov 4 PWR 1200

2016 Russia, Energoatom Baltic 1 PWR 1200

2016 Russia, Energoatom Seversk 1 PWR 1200

2016 Ukraine, Energoatom Khmelnitsky 3 PWR 1000

2016 India, NPCIL Kakrapar 4 PHWR 640

2016 India, NPCIL Rajasthan 7 PHWR 640

2016 China, several

2017 Russia, Energoatom Leningrad II-3 PWR 1200

2017 Ukraine, Energoatom Khmelnitsky 4 PWR 1000

2017 India, NPCIL Rajasthan 8 PHWR 640

2017 Romania, SNN Cernavoda 4 PHWR 655

2017 China, several

* Latest announced year of proposed commercial operation. Rostov = Volgodonsk

Black Swan Insights