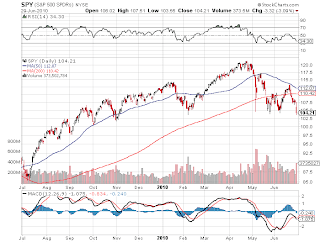

While today's action was brutal and senseless it is starting to confirm a distinct shift in the character of the market. We may be on the verge on another bear market which could be equally as vicious as the last one. Generally speaking the best indicator of a bear market is whether the market is above or below the 200 day moving average. It is a simplistic indicator but it has been one of the more reliable indicators over the years. As you can see the market is now below the 200 day moving average and has been so for over a month. This is particularly serious and should not be ignored. The only debate right now is whether this is temporary. If you look back over the years you will often see that within bull markets, the market has brief dips below the 200 day moving average before resuming the uptrend. So the real question that we have to solve is if this dip below the 200 day is one of the those bull market dips or the beginning of a new bear market. Answering this question is never easy or a precise science but we shall try.

One thing to remember is that there is no one indicator that will always give you the correct answer, so it is best to assemble a few key indicators and see what they are all telling you. My next indicator is the US bond market which is composed of pretty smart people who have a good history of predicting recessions and thus bear markets in stocks. There are two key things to look for in the bond market--an inverted yield curve or a distinct flatness to the yield curve. Generally these signal that the bond market is expecting slow growth in the economy and low inflation. So what is the bond market telling us now? Well we have not seen an inversion but we have seen a flatting of the yield curve in respect to the 2/10 and 10/30. Furthermore the 10 year fell below 3.00% recently which was not seen since the fall of 2008 and we know what happened back then.

The next indicator I follow is the Yen Carry Trade (represented as AUD/JPY), which you know I think is one of the largest ponzi schemes in history. While this may be true, the carry trade is also one of the greatest sources of global liquidity as investors sell the yen short to buy more risky and high yielding assets to earn a spread. Because the spread is usually small 4-6% these enterprising investors use leverage to enhance their returns which makes their position even more dangerous to external shocks to the economy. Naturally these investors have to stay ahead of the market and are always on the lookout for potential problems that could ruin their investments. You will see that in the summer of 2007 the carry trade broke down quite violently as forced liquidations caused substantial losses in AUD/JPY. To me this is an indication that global liquidity was shrinking which could negatively impact stock prices. I use the same 200 day principal for Aud/Jpy things as with the SP 500 and things are good above and bad when things are below.

The dollar is another indicator that is helpful. When the dollar is going down global liquidity is expanding and asset prices are usually rising. Conversely when the dollar is declining global liquidity is contracting and asset prices are falling. Currently the dollar has rallied from a low of around 74 to around 86. The dollar is also above its 200 day moving average which indicates that this is a strong trend and not some simple bounce for the buck. The move in the dollar has been mainly due to problems in Europe but the reason is immaterial in my opinion. The important thing is that the dollar is incredibly well bid and this is usually a negative for stocks.

In conclusion, all four indicators I follow are flashing major warning signals that we are indeed entering a bear market. This does not mean that stocks are necessarily going to crash (that only occurs in October) but it does mean that stocks will most likely decline with the occasional and strong bear market rallies. But as always there are no absolutes in the market and these indicators are never 100% but it is some food for thought.

Black Swan Insights