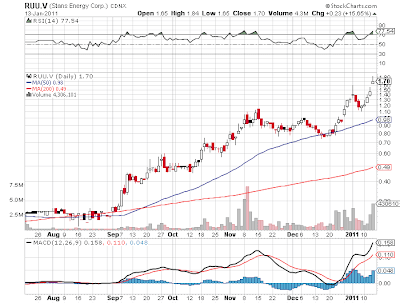

Position Sold 2/5/2011

As you know, I have owned Stans Energy since June 2010, and so far the investment has done well. Today we got some more good news from the company. Stans announced that it has optioned the chemical processing facility for $5,500,000. This represents a critical step for the company because the hardest part of mining rare earth elements is extracting the minerals from the ore. It can take a company years to solve all of the problems and refine the technique. Furthermore, the company also acquired a rail terminal which will allow it to ship the finished products to Asia. Stans made a point in the press release of mentioning South Korea and Japan as potential destinations for the final product.

As you know, I have owned Stans Energy since June 2010, and so far the investment has done well. Today we got some more good news from the company. Stans announced that it has optioned the chemical processing facility for $5,500,000. This represents a critical step for the company because the hardest part of mining rare earth elements is extracting the minerals from the ore. It can take a company years to solve all of the problems and refine the technique. Furthermore, the company also acquired a rail terminal which will allow it to ship the finished products to Asia. Stans made a point in the press release of mentioning South Korea and Japan as potential destinations for the final product.

This follows recent news reports that South Korea is interested looking to invest in rare earth mines in Kyrgyzstan. I expect news of a financing agreement to be announced in the next few months, which should elevate Stans Energy into the top-tier of rare earth companies. No other company (except Molycorp) can boast having a past producing mine and a rare earth processing facility where the metallurgy has already been solved. More importantly, Stans Energy is a HREE play compared to Molycorp, which is heavily reliant on LREEs (low value). If you look at the pricing of rare earth elements you will know that HREEs is where the big money will be made.

Regarding the processing facility, it was used previously to process output from Stans' Kutessay II mine back in the days when the Soviets were still around. According to a independent study, most of the equipment (97%) is in either good or satisfactory condition. This means that Stans should be able to keep capital expenditures relatively low (always good for shareholders). However, Stans will need additional capital to get the processing facility ready for operations, especially because they intend to increase capacity.

The only knock against Stans Energy right now is that it still trades on the American pink sheets, which keeps US institutions away from the stock. I would encourage the company to try to get a listing on a US exchange such as the American stock exchange. In fact, I have looked at the listing requirements, and Stans is eligible, so it definitely could be done. This is the only way to open up Stans Energy to large US investors, which would further support the stock price. Currently, US investors only consider Molycorp, Rare earth elements, and Avalon. No one outside of Canada has even heard of Stans Energy, and this needs to change, considering the company's attractive fundamentals and promising future. The cost of listing on an exchange would be minimal compared to the increase in market cap achieved through greater exposure to the investment community. A higher market cap will also allow the company to finance operations while minimizing dilution to shareholders.

Overall, I still like Stans Energy and have no intention of selling my shares.

Black Swan Insights

Related Articles:

My Investment in Stans Energy

Full Disclosure: I own stock in Stans Energy and am naturally talking my book.

Legal Disclaimer:

I am not an investment advisor and nothing on this site should be interpreted as investment advice. Please consult with your own financial advisor before investing in the stock market or any financial asset. This blog and its author are not responsible or liable for any misstatements and/or losses you might sustain from the content provided. (I know this is a stupid statement, but for legal purposes I have to say it. Thanks)

I've been looking for a reliable article on this for a few days, and this has been a fine help. I will be getting this tweeted for sure.

ReplyDeleteFeel free to visit my page; fast cash now

Great new a a fine energy stock.

ReplyDelete