Of course, a few months of weakness does not indicate a future recession, but it is worth keeping your eye on. Asia (led by China) has been the real powerhouse of growth for the world economy over the last 2 years, so it is important to look for any signs of a potential slowing in the region.

Further evidence of a slowdown in China is provided by Ambrose Evans-Pritchard who included two very revealing charts in his last article. The first chart shows Chinese orders of semi-manufactures from Taiwan. Pritchard noted:

“The indicator – which tends to anticipate China’s overall import growth quite accurately by about two months – has been decelerating for five consecutive months, from close to 60pc (y-on-y) in March to just 8.8pc in August. The product mix shows a sharp decline in China’s orders for electronics and IT products as well as other light manufacturing items such as precision instruments, clocks, and watches.”

click charts for larger image

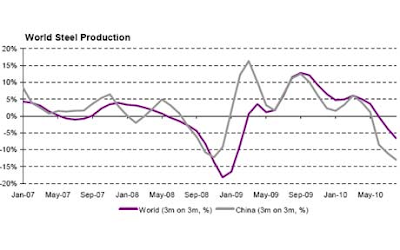

The second chart shows world steel production along with Chinese steel production through August 2010. You can see how much it has fallen. Current weakness in the steel market can be discerned from looking at the poor performance of steel stocks like US Steel, Nucor, etc. These stocks have not rallied at all despite the market's relentless advance.

Black Swan Insights

Nice Post about an Air Fright very useful this new trends. Thanks For sharing this post. Please share new post about an Air Fright.

ReplyDeleteAir Fright Transportation

Worry about the USA not asia.

ReplyDeleteGood elaboration on the topic of air cargo shipping process and procedures.

ReplyDeleteThis is a very burning topic and most open debate should be held to cover this topic by aviation experts.

ReplyDeleteAir Freight Services